Moody's Analytics: Weakened trade patterns, persistent inflation to dampen APAC growth

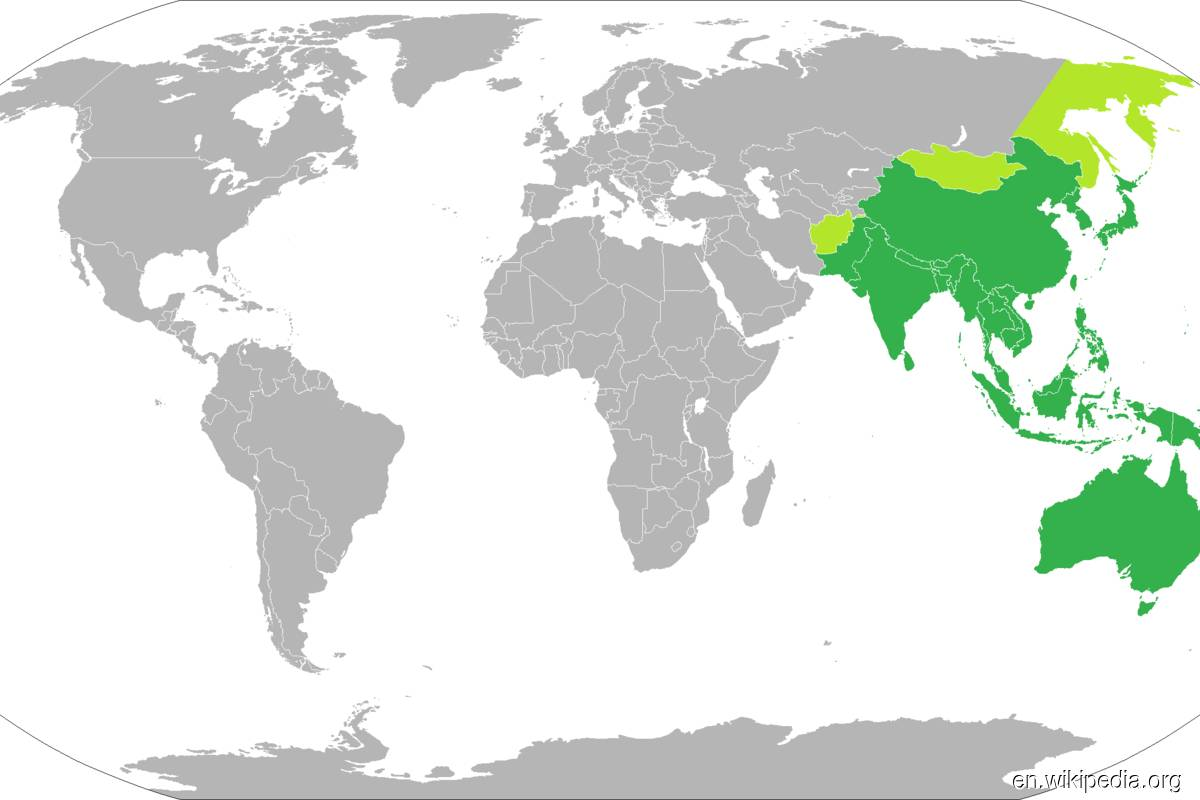

Weakened trade patterns and persistent inflation will dampen economic growth in the second half of this year, but 2022 will maintain its general pattern of economic recovery and expansion across the Asia Pacific (APAC) region, said Moody’s Analytics on Tuesday (Aug 16).

Moody在8月16日分析称,贸易模式减弱和持续通胀将抑制今年下半年的经济增长,但 2022 年将保持其整个亚太地区(APAC)经济复苏和扩张的总体格局。

In its analysis titled “APAC Outlook: Surviving the Year’s Rocky and Uneven Start”, the research firm said rounding out the regional leaders for this year, Malaysia and Indonesia will benefit from high commodity prices this year, even if many prices have already peaked or soon will.

该研究公司在其题为“亚太地区展望:度过艰难和不平衡的开局”的分析中表示,在今年的区域领导者中,马来西亚和印度尼西亚将受益于今年的高商品价格,即使许多价格已经见顶或很快就会。

Moody’s Analytics said the outlook for the remainder of this year has shifted the most for China and Hong Kong, with real gross domestic product (GDP) growth this year in China projected to reach only 3.4%.

Moody分析表示,今年余下时间的前景对中国大陆和香港的变化最大,中国今年的实际国内生产总值 (GDP) 增长率预计仅为 3.4%。

“Our July forecast estimate of 4.3% was lowered by the lack of a significant impact from the housing market or consumer spending stimulus and the quarterly GDP decline in the second quarter,” it added.

它补充说:“由于房地产市场或消费者支出刺激措施没有产生重大影响以及第二季度的季度 GDP 下降,我们下调了 7 月份的 4.3% 预测。”

It noted that the continuation of Covid-19-related restrictions in China through mid-August added to this uncertainty, although current restrictions are limited and located inland, away from major manufacturing and shipping centres.

它指出,中国持续到 8 月中旬与 Covid-19 相关的限制增加了这种不确定性,尽管目前的限制是有限的,并且位于内陆,远离主要制造和航运中心。

Moody’s Analytics said the greatest uncertainty within the APAC region was inflation.

Moody分析表示,亚太地区最大的不确定性是通胀。

“While global oil prices specifically and commodity prices in general have begun to ease over the past month, this trend is not yet reflected in consumer price inflation across the region. Inflation remains well above where it was at the beginning of this year and above most central bank target ranges,” it added.

“虽然全球石油价格和大宗商品价格在过去一个月开始回落,但这一趋势尚未反映在整个地区的消费者价格通胀中。通胀仍远高于今年年初的水平,也高于大多数央行的目标区间,”它补充道。

The research firm said South and Southeast Asia face the greatest risk from a surprise in inflation and this could slow local demand for goods and services, including housing.

该研究公司表示,南亚和东南亚面临通胀意外的最大风险,这可能会减缓当地对包括住房在内的商品和服务的需求。

Moody’s Analytics pointed out that Japan, South Korea and Taiwan are more highly exposed to further supply chain disruptions from China for electronics and components. A faster than expected decline in commodity prices would dampen the economies of Australia, Indonesia and Malaysia,” it said.

Moody分析指出,日本、韩国和台湾更容易受到来自中国的电子和零部件供应链进一步中断的影响。大宗商品价格下跌速度快于预期将抑制澳大利亚、印度尼西亚和马来西亚的经济,”它说。

It said economic growth in 2023 for APAC is expected to decelerate, following similar slowdowns in North America and Europe, as they absorb higher interest rates.

它表示,由于北美和欧洲吸收了更高的利率,因此预计 2023 年亚太地区的经济增长将减速。

Within the APAC region, only China is expected to improve significantly next year, assuming policymakers will ease up on the dynamic zero-Covid policies, so that the risk of local shutdowns will be greatly reduced, and international travel restrictions in and out of China loosened, it added.

在亚太地区,预计明年只有中国会显着改善,前提是政策制定者将放松动态的零疫情政策,从而大大降低当地停工的风险,放宽进出中国的国际旅行限制,它补充说。

“There remains much uncertainty about the housing market, but current efforts at providing bailout funds for property developers should be felt next year, as more units are completed and delivered to buyers,” said Moody’s Analytics.

“房地产市场仍然存在很大不确定性,但明年应该会感受到目前为房地产开发商提供救助资金的努力,因为更多的单元已经完工并交付给买家,”Moody分析表示.