Bank Negara teams up with MoF, SC to regulate BNPL schemes

KUALA LUMPUR, March 30 (Bernama) – Bank Negara Malaysia (BNM) BNM is working together with the Ministry of Finance (MoF) and Securities Commission Malaysia (SC) to regulate and monitor “Buy Now Pay Later” (BNPL) schemes through the enactment of the Consumer Credit Act this year.

KUALA LUMPUR, March 30 (Bernama) – Bank Negara Malaysia (BNM) BNM is working together with the Ministry of Finance (MoF) and Securities Commission Malaysia (SC) to regulate and monitor “Buy Now Pay Later” (BNPL) schemes through the enactment of the Consumer Credit Act this year.

马来西亚国家银行(BNM)BNM正在与财政部(MoF)和马来西亚证券委员会(SC)合作,通过今年颁布的"消费者信贷法"来规范和监控"先买后付"(BNPL)计划。

BNPL schemes, which are currently offered by non-bank operators, do not fall within the BNM regulatory purview or any regulatory agency, said the central bank in its Annual Report 2021 released on 30 March.

央行在3月30日发布的2021年年度报告中表示,目前由非银行运营商提供的BNPL计划不属于马来西亚国家银行的监管范围或任何监管机构。

“To further mitigate the risks that BNPL schemes may encourage consumers to spend beyond their means, we have also worked with the Financial Education Network to educate the public on the risks of using BNPL schemes,” BNM said.

"为了进一步减轻BNPL计划可能鼓励消费者超出其能力范围的支出的风险,我们还与金融教育网络合作,教育公众使用BNPL计划的风险,"BNM说。

It added that for BNPL schemes offered by, or in partnership with banking institutions, the banking institutions are expected to observe practices that are consistent with responsible lending expectations.

它补充说,对于由银行机构提供或与银行机构合作提供的BNPL计划,银行机构应遵守符合负责任贷款预期的做法。

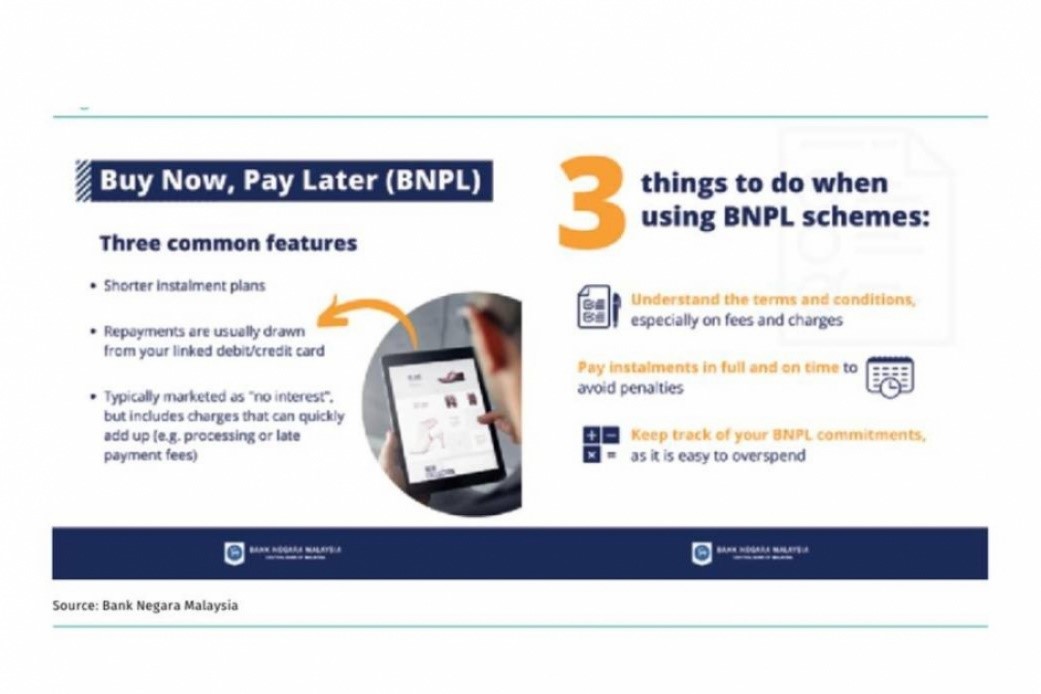

BNM explained that BNPL allows customers to make payments in instalments with zero interest, however, there may be other charges levied on the customers, such as processing and late payment fees.

BNM解释说,BNPL允许客户分期付款,零利息,但是,可能会对客户征收其他费用,例如处理费和滞纳金。

In some cases, the total charges levied by BNPL providers on the customers may be higher than the total interest and charges imposed by conventional lenders.

在某些情况下,BNPL提供商向客户征收的总费用可能高于传统贷款人征收的总利息和费用。

As such, BNM suggests that the lender understand the terms and conditions, especially on fees and chargers before using BNPL schemes.

因此,BNM建议贷款人在使用BNPL计划之前了解条款和条件,特别是有关费用和充电器的条款和条件。

“Lenders need to pay instalments in full and on time to avoid penalties and keep track of your BNPL commitments as it is easy to overspend when you use the schemes,” said BNM.

"贷款人需要按时足额支付分期付款,以避免罚款并跟踪您的BNPL承诺,因为当您使用这些计划时很容易超支,"BNM说。