Bond markets showing turnaround signs in emerging Asia

Signs of better news of inflation and foreign inflows are appearing for emerging Asia bonds, helping to prime the market for a recovery once the US Federal Reserve (Fed) turns less hawkish.

新兴亚洲债券出现通胀和外国资金流入的好消息迹象,一旦美联储 (Fed) 变得不那么鹰派,有助于为复苏做好准备。

Goldman Sachs Group Inc said an improving inflation outlook would have a material impact at this stage. The latest consumer-price data for South Korea, Thailand and the Philippines came in below estimates, while some sovereign debt saw foreign money return. The repercussions of an aggressive Fed on some emerging Asia notes are also waning, analysis showed.

高盛集团表示,通胀前景改善将在现阶段产生重大影响。韩国、泰国和菲律宾的最新消费者价格数据低于预期,而一些主权债务则出现了外国资金回流。分析显示,激进的美联储对一些新兴亚洲债券的影响也在减弱。

Any peak in inflation or rate expectations in the US may be the green light that Asia’s emerging debt markets need for a more sustained rally. An index of emerging Asia bonds has fallen about 1.4% in the third quarter so far, in line with US Treasuries. That compares with a loss of 6% in the three months ended June.

美国通胀或利率预期的任何峰值都可能为亚洲新兴债务市场提供更持续反弹所需的绿灯。迄今为止,新兴亚洲债券指数在第三季度已下跌约 1.4%,与美国国债持平。相比之下,截至 6 月的三个月中损失了 6%。

“The local dynamics are much more important a driver than before” for Asian local-currency bonds, said Jin Yang Lee, an investment manager for sovereign debt at abrdn plc in Singapore. “We are generally quite comfortable with extending the duration on weakness in markets that have lower sensitivity to US Treasuries,” he added.

新加坡 abrdn plc 主权债务投资经理 Jin Yang Lee 表示,对于亚洲本币债券来说,“本地动态比以前更重要”。“我们通常对延长对美国国债敏感性较低的市场疲软的持续时间感到满意,”他补充道。

These three charts show how conditions are turning more supportive:

这三个图表显示了条件如何变得更加有利:

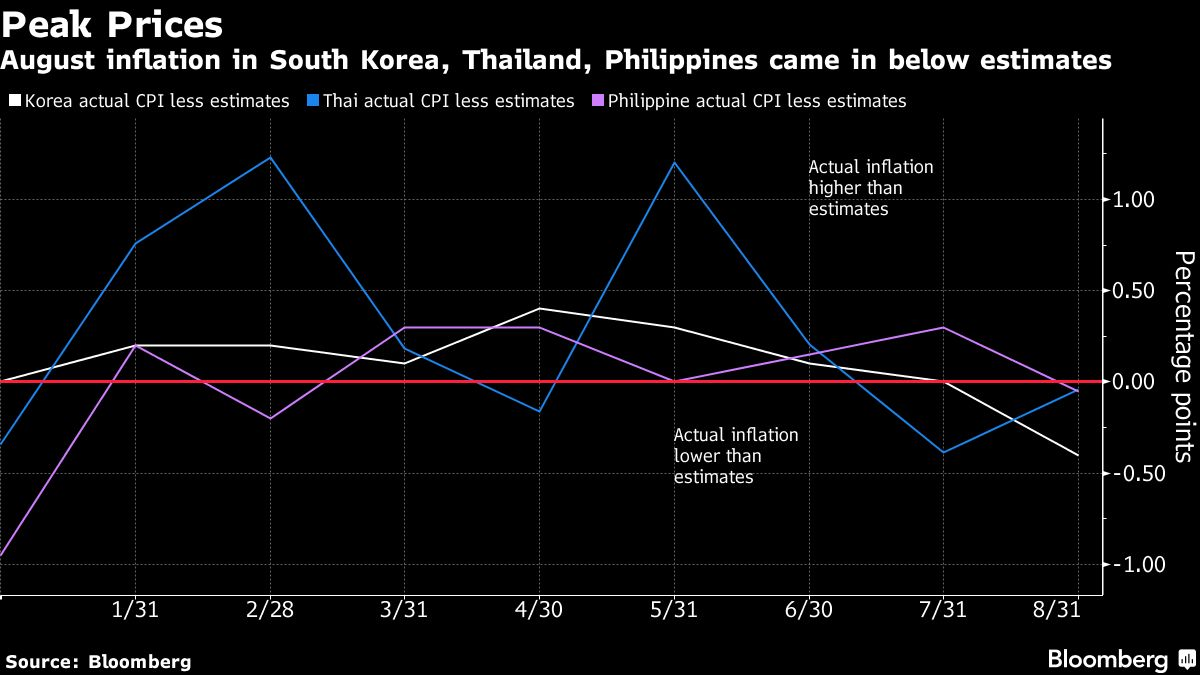

1. Peak inflation 通货膨胀高峰

Analysts have been looking for signs of peak domestic inflation as one of the buy signals to return to bonds, with one catalyst a consistent trend of data undershooting estimates.

分析师一直在寻找国内通胀见顶的迹象,作为回归债券的买入信号之一,其中一个催化剂是数据始终低于预期的趋势。

South Korea’s inflation is showing signs of topping out, with prices rising 5.7% in August from a year before, the first time in 10 months the figures have come in below economists’ projections. The Bank of Korea is the most advanced in the region in terms of rate hikes, and receding inflationary concerns mean it may be the first to conclude the cycle.

韩国的通胀出现触顶迹象,8 月份物价同比上涨 5.7%,这是 10 个月来首次低于经济学家的预测。韩国央行在加息方面是该地区最先进的,通胀担忧消退意味着它可能是第一个结束周期的央行。

Similarly, August inflation in the Philippines was below estimates for the first time in six months, while data in Thailand came in below forecasts. India will release August retail inflation figures on 12th September.

同样,菲律宾 8 月份的通胀率六个月来首次低于预期,而泰国的数据低于预期。印度将于 9 月 12 日发布 8 月零售通胀数据。

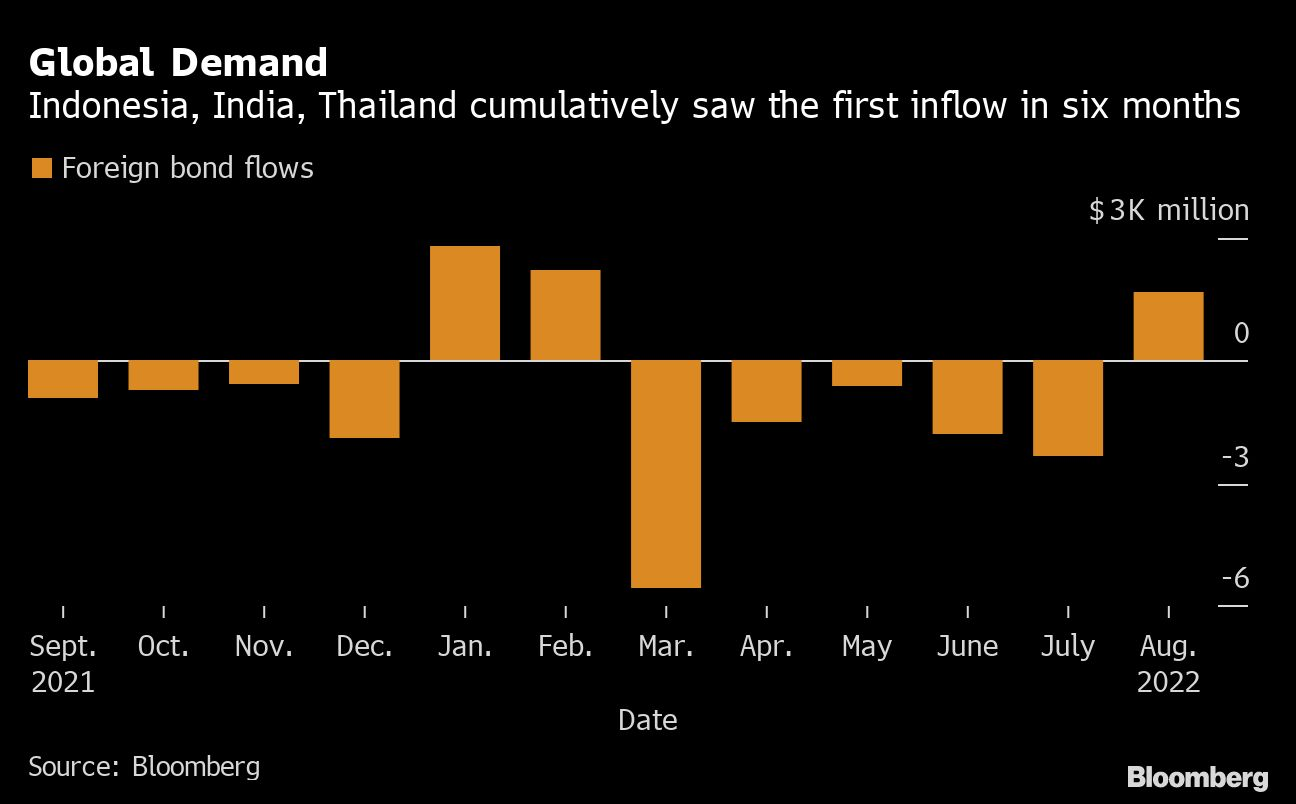

2. Foreign bond inflows 外国债券流入

India and Indonesia recorded net foreign bond inflows in August, their first addition in at least six months, while global funds poured into Thai debt for the first time since May.

印度和印度尼西亚 8 月录得外国债券净流入,这是至少六个月来首次增加,而全球资金自 5 月以来首次涌入泰国债券。

While the bulk was mainly after the dovish July Fed decision, the trend suggests that global funds see positives in the region, such as light foreign bond positioning and more moderate policy tightening. This hints at more significant inflows if the Fed dials back.

虽然大部分主要是在美联储 7 月鸽派决定之后,但趋势表明,全球基金在该地区看到了积极因素,例如外国债券仓位清淡和政策收紧更为温和。如果美联储回拨,这暗示会有更多的资金流入。

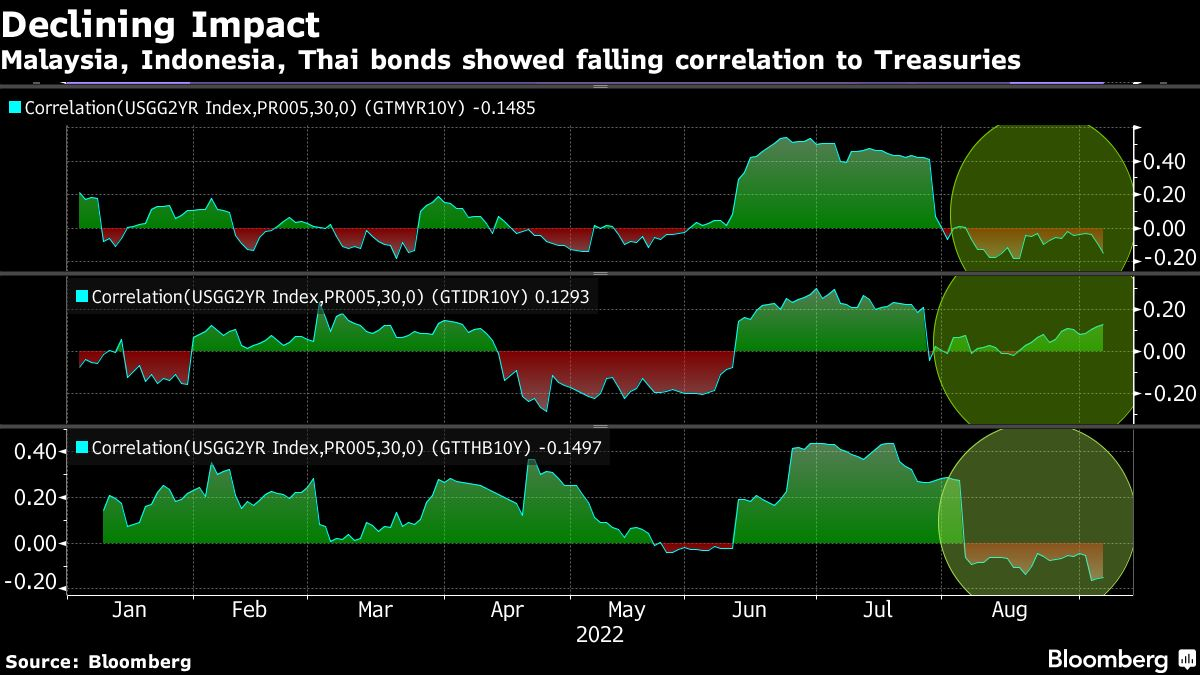

3. Lower sensitivity to hawkish US bets 对鹰派美国押注的敏感性降低

Thai, Malaysian and Indonesian 10-year yields proved to be less vulnerable to hawkish US expectations in August. The correlation with two-year Treasury yields fell, even as the shorter-tenor US yields surged to a near 15-year high, following last month’s Jackson Hole symposium.

事实证明,泰国、马来西亚和印度尼西亚的 10 年期国债收益率在 8 月份不太容易受到美国鹰派预期的影响。与两年期国债收益率的相关性下降,尽管在上个月的杰克逊霍尔研讨会之后,美国短期收益率飙升至近 15 年高位。