Could a surge in the price of crude oil trigger a recession?

FOR decades, recessions have often been linked to a sudden surge in crude oil prices. Post-World War 2, at least six incidents of oil price shocks have occurred and in almost all the cases, economic downturns have ensued.

几十年来,经济衰退往往与原油价格的突然飙升有关。 第二次世界大战后,至少发生了六起油价冲击事件,几乎所有情况下,经济衰退都随之而来。

This includes the 2007-2008 Great Recession, which is often attributed to the subprime mortgage crisis that started in the United States. There are theories that the oil price run-up of 2007-2008 had partly triggered the Great Recession. Given the impact caused by oil shocks in the past, it is not surprising that recessionary fears flared after the Russia-Ukraine conflict erupted.

这包括2007-2008年的大衰退,这通常归因于始于美国的次贷危机。有理论认为,2007-2008年的油价上涨部分引发了大衰退。 鉴于过去石油冲击造成的影响,在俄罗斯 - 乌克兰冲突爆发后爆发衰退担忧并不奇怪。

Global stock markets tumbled, with investors seeking refuge in less risky assets such as gold.

全球股市暴跌,投资者寻求黄金等风险较低的资产的庇护。

The market’s panic is understandable. After all, Russia is the world’s third biggest crude oil producer, providing about one of every 10 barrels the global economy consumes.

市场的恐慌是可以理解的。毕竟,俄罗斯是世界第三大原油生产国,提供全球经济消费的每10桶石油中的一桶。

A disruption in the Russian oil production could leave a significant gap in global supply and further push the oil price.

俄罗斯石油生产的中断可能会给全球供应留下重大缺口,并进一步推高油价。

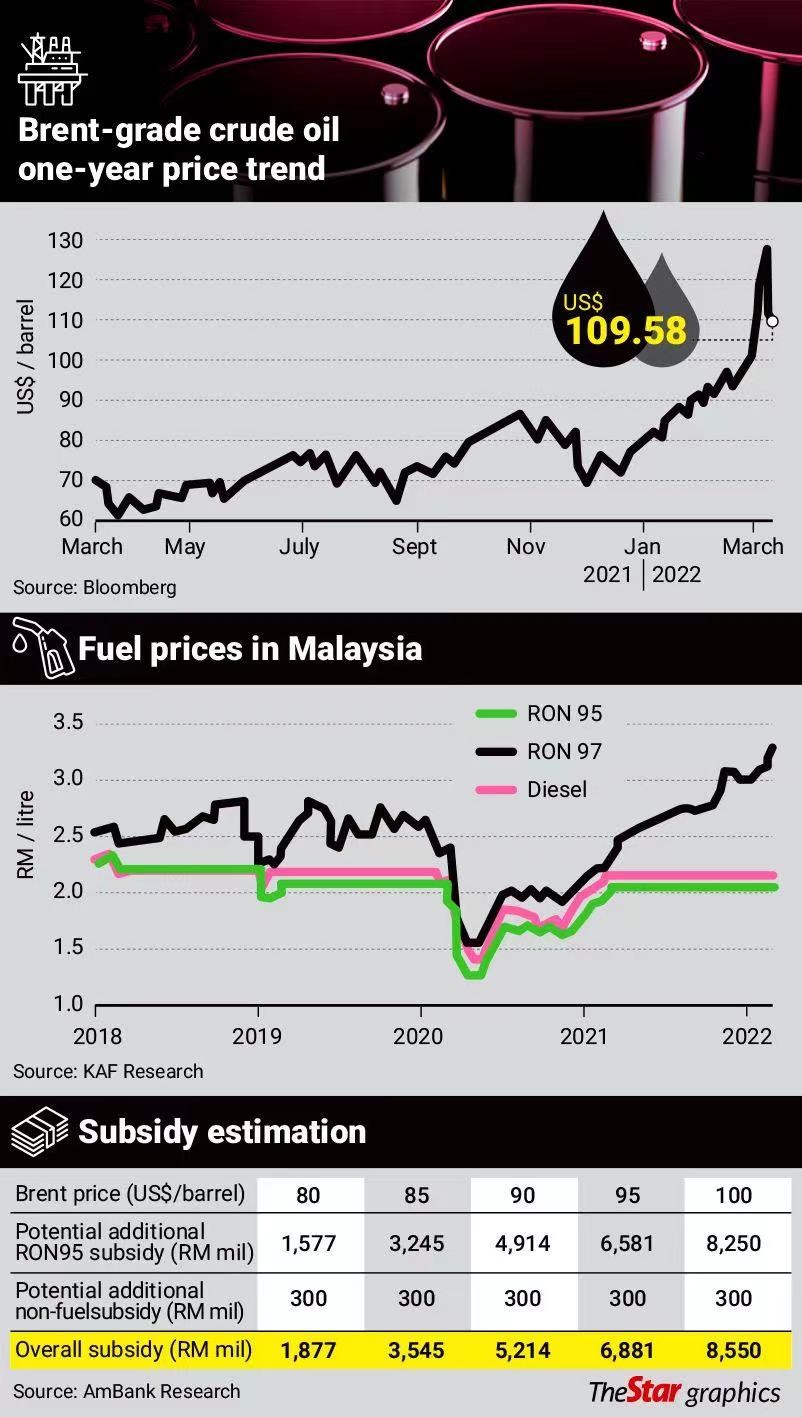

To be sure, global crude oil prices have been on the rise since 2021, but the Russian invasion of Ukraine sent the prices skyrocketing to above US$100 (RM419) per barrel.

可以肯定的是,自2021年以来,全球原油价格一直在上涨,但俄罗斯入侵乌克兰导致价格飙升至每桶100美元(419令吉)以上。

In slightly over two months, both Brent and West Texas Intermediate grade crude oil prices had jumped by almost US$50 (RM209) per barrel.

在略多于两个月的时间里,布伦特原油和西德克萨斯中质原油价格都上涨了近50美元(209令吉)每桶。

The sudden surge in oil prices has sparked a million-dollar-question, will the world face a double-dip recession?

油价的突然飙升引发了一个百万美元的问题,世界会面临双底衰退吗?

Just as the global economy is recovering from the debilitating effects of the Covid-19 pandemic, another recession in a short gap would be disastrous for the world.

正如全球经济正在从Covid-19大流行的衰弱影响中恢复过来一样,在短时间内的另一次衰退对世界来说将是灾难性的。

In January 2022, prior to the Russia-Ukraine conflict, the World Bank had predicted the global economy to expand slower by 4.1% in 2022, as compared to a growth of 5.5% in 2021 and a contraction of 3.4% in 2020.

2022年1月,在俄罗斯-乌克兰冲突之前,世界银行曾预测2022年全球经济增长将放缓4.1%,而2021年为5.5%,2020年为收缩3.4%。

OCBC Bank economist Howie Lee cautions that the probability of a double-dip recession is rising.

华侨银行(OCBC Bank)经济学家Howie Lee警告说,双底衰退的可能性正在上升。

“So, we would have one in 2020 over the pandemic, and then one now as we grapple with runaway inflation.

"因此,我们将在2020年因大流行而有一个,然后现在在我们努力应对失控的通货膨胀时有一个。

“Untamed inflation leads to lower consumption and productivity, which softens economic activity and may lead to a recession,” he tells StarBizWeek.

"顽固的通货膨胀导致消费和生产率下降,从而软化经济活动,并可能导致经济衰退,"他告诉StarBizWeek。

Socio-Economic Research Centre (SERC) executive director Lee Heng Guie says that Russia’s invasion on Ukraine has triggered negative supply and oil price shocks, which pose a double-blow to the world economy by further denting growth prospects and driving higher inflation.

社会经济研究中心(SERC)执行主任Lee Heng Guie表示,俄罗斯入侵乌克兰引发了负面供应和油价冲击,通过进一步削弱增长前景和推动通胀上升,对世界经济构成双重打击。

He also adds that the risk of stagflation and recessionary conditions have risen in some advanced economies, especially in the US and European countries.

他还补充说,一些发达经济体的滞胀和衰退风险已经上升,特别是在美国和欧洲国家。

High inflation and soaring fuel prices have dented consumer spending and businesses’ margin.

高通胀和飙升的燃料价格削弱了消费者支出和企业的利润率。

“The United States Federal Reserve’s resolve of containing a surge in inflation pressure through possibly aggressive interest rate hikes could slow the US economy sharply and may tip it into recession,” he says.

"美联储决心通过可能激进的加息来遏制通胀压力的激增,这可能会大幅减缓美国经济,并可能使其陷入衰退,"他说。

Echoing a similar stance, economist Dr Geoffrey Williams of the Malaysia University of Science and Technology (MUST) points out that a recession in oil dependent countries might follow a prolonged increase in oil prices.

马来西亚科技大学(MUST)的经济学家杰弗里·威廉姆斯(Geoffrey Williams)博士也表达了类似的立场,他指出,石油依赖型国家的经济衰退可能会在油价长期上涨之后出现。

However, for oil rich countries like Malaysia, higher oil prices will raise gross domestic product (GDP) and government revenue, he says.

然而,他说,对于像马来西亚这样石油资源丰富的国家来说,油价上涨将提高国内生产总值(GDP)和政府收入。

“So it is not so simple to say the oil price rise will cause recession.

"因此,说油价上涨会导致经济衰退并不是那么简单。

“If there is a sharp increase in US and European interest rates to try to slow inflation, which wouldn’t work, then this could stifle growth but I don’t think it would cause recession because their economies are rebounding strongly,” he says.

"如果美国和欧洲的利率大幅上升,试图减缓通胀,这是行不通的,那么这可能会扼杀经济增长,但我认为这不会导致经济衰退,因为他们的经济正在强劲反弹,"他说。

Nevertheless, Williams adds Malaysia could still be harmed, if global trade contracts severely because of weaker economic conditions in the US and European economies.

尽管如此,威廉姆斯补充说,如果全球贸易因美国和欧洲经济状况疲软而严重收缩,马来西亚仍可能受到伤害。

“In a nutshell, recessions are more commonly caused by bad policy overreaction rather than oil price rises.

"简而言之,经济衰退更常见于糟糕的政策过度反应,而不是油价上涨。

“That’s why Bank Negara should keep its head, tie itself to the mast like Ulysses and resist the siren calls for higher interest rates,” according to him.

"这就是为什么国家银行应该保持头脑清醒,像尤利西斯一样将自己绑在桅杆上,并抵制要求提高利率的警报,"他说。

Malaysian Rating Corp Bhd (MARC) chief economist Firdaos Rosli also thinks that the probability of a double-dip recession is “very remote” for Malaysia.

马来西亚评级公司(MARC)首席经济学家Firdaos Rosli也认为,马来西亚出现双底衰退的可能性"非常小"。

This is considering the fact that the local economy is restarting from a very low base while reopening has been progressive thus far.

这是考虑到当地经济正在从非常低的基数重新开始,而重新开放到目前为止一直是进步的。

“For now, we continue to expect 5.7% growth in 2022,” he says.

"目前,我们继续预计2022年将增长5.7%,"他说。

A sudden surge in oil prices causes panic as it leads to increased costs for businesses and households.

油价的突然飙升引起了恐慌,因为它导致企业和家庭的成本增加。

If the government and central banks do not step in fast enough to remedy the situation, the production of businesses will be disrupted and the higher business costs will be passed on to the consumers.

如果政府和中央银行不采取足够快的步伐来纠正这种情况,企业的生产将被打乱,更高的商业成本将转嫁给消费者。

The impact will be worse for oil importing nations. The surging oil price trend has somewhat cooled down in the last three days, although prices remain elevated at US$112 (RM469) per barrel yesterday as at press time.

对石油进口国的影响将更严重。过去三天,飙升的油价趋势有所降温,但截至发稿时,昨日油价仍高企至每桶112美元(469令吉)。

Where Malaysia stands?

马来西亚的立场是什么?

In the case of Malaysia, high oil prices are a double-edged sword. On one hand, thanks to nationalised petroleum ownership, the government benefits from high crude oil prices and the taxes related to petroleum.

就马来西亚而言,高油价是一把双刃剑。一方面,由于石油所有权国有化,政府受益于高原油价格和与石油有关的税收。

Malaysia’s Tapis crude oil, which was long known as the world’s most expensive grade, hit its record-high of US$133.79 (RM560) per barrel on 9th March.

马来西亚的Tapis原油长期以来一直被称为世界上最昂贵的等级,3月9日创下每桶133.79美元(RM560)的历史新高。

In comparison, the global benchmark Brent crude oil reached a multi-year-high of US$127.98 (RM536) per barrel on 8th March.

相比之下,全球基准布伦特原油在3月8日达到每桶127.98美元(RM536)的多年高点。

For 2022, the government’s petroleum-related revenue is forecast to register RM43.9bil or 18.8% to total revenue, with dividends from Petronas accounting for more than half of the total.

到2022年,政府的石油相关收入预计将达到439亿令吉,占总收入的18.8%,马来西亚国家石油公司的股息占总额的一半以上。

The projection is based on the Finance Ministry’s budgeted average crude oil price at US$66 (RM276) per barrel.

该预测基于财政部预算的平均原油价格为每桶66美元(RM276)。

Since March, crude oil prices have stayed above US$100 (RM419) per barrel, much-higher than the government’s earlier forecast.

自3月以来,原油价格一直保持在每桶100美元(419令吉)以上,远高于政府早些时候的预测。

According to the Asean+3 Macroeconomic Research Office, for every US$1 (RM4.19) increase in Brent oil prices, Malaysia's annual fiscal revenue would rise by about RM339mil and the real GDP would increase by approximately RM646mil.

根据东盟+3宏观经济研究办公室的数据,布伦特原油价格每上涨1美元(4.19令吉),马来西亚的年度财政收入将增加约3.39亿令吉,实际GDP将增加约6.46亿令吉。However, MARC's Firdaos expects the net impact of high global oil prices on Malaysia is likely to be neutral.

“Fiscal policy will do most of the heavy lifting to cushion cost-push inflation to consumers. The government will keep inflation at bay as we move closer to the 15th General Election.

"财政政策将承担大部分繁重的工作,以缓解消费者的成本推动通胀。随着我们接近第15届大选,政府将抑制通货膨胀。

“Having said that, the muted impact would also mean the urgency to push for structural reforms is absent,” he says.

"话虽如此,这种微弱的影响也意味着推动结构性改革的紧迫性不存在,"他说。

Similarly, Must’s Geoffrey also says that the impact from high oil prices will be “muted” for Malaysia, considering the huge blanket fuel subsidies given at the moment.

同样,Must的杰弗里还表示,考虑到目前给予的巨额一揽子燃料补贴,高油价对马来西亚的影响将"减弱"。

For example, for RON95 petrol, consumers in Malaysia only pay RM2.05 per litre, although the actual cost in March has reached RM3.70 per litre.

例如,对于RON95汽油,马来西亚的消费者只需支付每升2.05令吉,尽管3月份的实际成本已达到每升3.70令吉。

Meanwhile, for diesel, consumers only pay RM2.15 per litre, while the actual cost has exceeded RM4 per litre.

同时,对于柴油,消费者每升只需支付RM2.15,而实际成本已超过每升RM4。

The cost differences are subsidised by the government.

成本差异由政府补贴。

Finance Minister Datuk Seri Tengku Zafrul Tengku Abdul Aziz recently told the Parliament that the government is subsidising as much as 45% of the total fuel price. With the recent price increase, he said, the subsidy for petrol, diesel and liquefied petroleum gas was expected to reach RM2.5bil per month.

财政部长Dato Seri Zafrul Tengku Abdul Aziz最近告诉议会,政府补贴高达燃料总价的45%。他说,随着最近价格的上涨,汽油,柴油和液化石油气的补贴预计将达到每月25亿令吉。

For the full-year of 2022, he said the government could be paying up to RM28bil in fuel subsidies.

他说,对于2022年的全年,政府可能会支付高达280亿令吉的燃料补贴。

Considering the sharp rise in oil prices, Tengku Zafrul said that the current fuel subsidy will be reviewed in favour of a targeted programme for the needy.

考虑到油价的急剧上涨,Tengku Zafrul表示,将审查目前的燃料补贴,以支持针对有需要的人的计划。

“Therefore, the government will review the fuel subsidy mechanism in order to implement a more targeted and focused aid and subsidy to the vulnerable and those really in need,” Tengku Zafrul said on 10th March.

"因此,政府将审查燃料补贴机制,以便对弱势群体和真正有需要的人实施更有针对性和重点的援助和补贴,"Tengku Zafrul在3月10日表示。

MUST’s Geoffrey thinks that there is no need to remove the fuel subsidy.

MUST的杰弗里认为没有必要取消燃料补贴。

“If the subsidy was removed it would have huge negative welfare implications on all Malaysians, whether they drive or not and especially on lower income drivers who often depend on fuel for work and would be hardest hit if prices rose.

"如果取消补贴,它将对所有马来西亚人产生巨大的负面福利影响,无论他们是否开车,特别是低收入司机,他们经常依靠燃料工作,如果价格上涨,他们将受到最严重的打击。

“We have to ride out the storm, keep the fuel subsidy, keep interest rates on hold, control prices of food and remove the utilities price hike on businesses introduced last month. This will help keep inflation down,” according to him.

"我们必须渡过难关,保持燃料补贴,保持利率不变,控制食品价格,并消除上个月引入的企业公用事业价格上涨。这将有助于降低通货膨胀,"他说。

In recent months, more Malaysians have been complaining about the rising inflationary pressures, including among many necessity items such as poultry products.

近几个月来,越来越多的马来西亚人抱怨通胀压力上升,包括家禽产品等许多必需品。

Earlier this month, Bank Negara has said that the country's underlying inflation, as measured by core inflation, is expected to normalise to around its long-term average as economic activity continues to pick up amid the environment of high input costs.

本月早些时候,国家银行(Bank Negara)表示,以核心通胀衡量,该国的潜在通胀预计将正常化至长期平均水平附近,因为经济活动在高投入成本的环境下继续回升。

“Nevertheless, core inflation is expected to be modest, with the upside risk partly contained by the continued slack in the economy and labour market.

"尽管如此,核心通胀预计将温和,上行风险部分受到经济和劳动力市场持续疲软的遏制。

“The inflation outlook continues to be subject to global commodity price developments amid risks from prolonged supply-related disruptions,” it says.

"通胀前景继续受到全球大宗商品价格走势的影响,因为长期与供应相关的中断存在风险,"它说。

On the global front, OCBC’s Lee opines that inflationary pressures will continue, moving forward.

在全球方面,华侨银行的Lee认为,通胀压力将继续向前发展。

“Short of Russia reaching a peace deal with the West, I cannot think of a scenario where inflation won’t continue rearing its ugly head.

"除非俄罗斯与西方达成和平协议,否则我想不出通货膨胀不会继续抬起丑陋的头。

“The question now is really how high would the pace of inflation be,” he says.

"现在的问题是,通货膨胀的速度会有多高,"他说。

Amid the threat of inflation, SERC’s Lee believes that a viable approach is to raise the fuel price gradually and eventually move towards a managed float regime for RON95 and diesel.

在通货膨胀的威胁下,SERC的Lee认为,一个可行的方法是逐步提高燃料价格,并最终转向RON95和柴油的管理浮动制度。

“The managed float regime will be accompanied by a targeted fuel subsidy for the low-income households,” he says.

"管理浮动制度将伴随着对低收入家庭的有针对性的燃料补贴,"他说。

Meanwhile, HELP University’s economist Dr Paolo Casadio says the government has to think in terms of cross-subsidies, redistributing costs and benefits among the government linked companies as well as not keeping a neutral stance in allowing the additional business costs to be passed onto the consumers.

与此同时,HELP大学的经济学家Paolo Casadio博士表示,政府必须考虑交叉补贴,在政府相关公司之间重新分配成本和收益,以及不允许将额外的商业成本转嫁给消费者时保持中立立场。

“With the right policy Malaysia can cope with this crisis, overperforming the other countries and increasing its competitiveness.

"通过正确的政策,马来西亚可以应对这场危机,超越其他国家并提高其竞争力。

“These are all important factors conditioning the potential growth over the long run,” he says.

"从长远来看,这些都是影响潜在增长的重要因素,"他说。

By allowing fuel prices to adjust upwards, Casadio says it would expose the Malaysian economy to more negative effects on growth and inflation.

通过允许燃料价格上涨,卡萨迪奥表示,这将使马来西亚经济对增长和通胀产生更大的负面影响。

“The rise in the energy tariff would be, in this scenario, a tragic mistake to avoid at all costs,” he say

"在这种情况下,能源关税的上涨将是一个不惜一切代价避免的悲剧性错误,"他说。